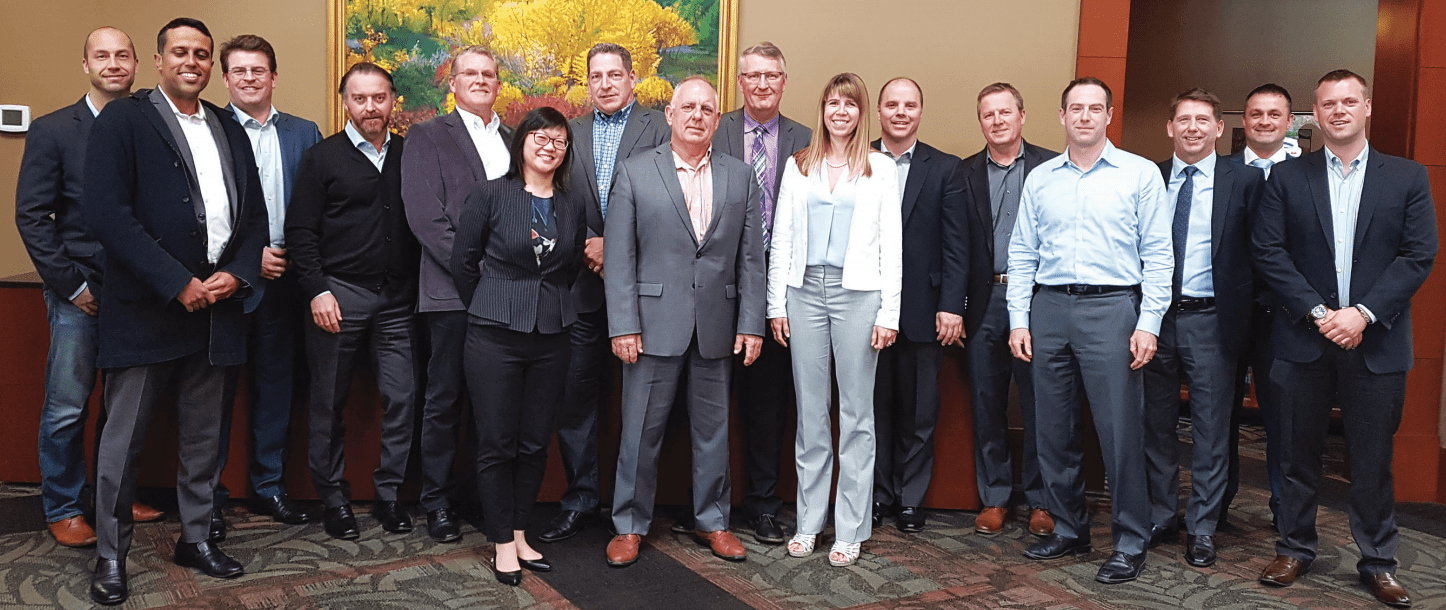

Image: Members of the Benefits Alliance Group’s Western Regional Advisory Drug Forum were, from left: Scott Dedels, Capri Insurance; Faizal Mitha, ES3 Insurance Services Ltd.; David Holm, ONYX Financial Group; John Goode, Belay Advisory; Ian Watson, Fairfield Watson; Connie Wong, Pfizer Canada Inc.; Tony Fairfield, Fairfield, Watson; Gil McGowan, The Benefits Alliance Group; Steve Long, S.C. Long Consulting Ltd; Andrea Hansen, Sutton Financial Group; Glenn Kehrer, Group Benefits Consulting of Canada Inc.; Mark Canduro, MSC Financial Group Inc.; Martin Hulme, ONYX Financial Group; Richard York, Merck Canada Inc.; Lee Swift, Merck Canada Inc., and Matt Lister, Davis Benefits & Pensions Ltd.

This is a time for self-reflection around benefit plan design, says Steve Long, of S. C. Long Consulting Ltd. An independent expert in health systems and pharmacy benefit management, he led the discussion at The Benefits Alliance Group’s ‘Western Regional Advisory Drug Forum.’ Sponsored by Merck Canada and Pfizer Canada, this session builds on the conversations from its ‘Eastern Roundtable Advisors Forum’ held in January of this year.

Putting the health system in context means advisors and their clients need to start asking whether the benefits plan strategy is a cost or an investment. They need to determine what their health claims data tells them about the health of their plans and covered members; whether they are focusing on the right part of their benefit plan spend (the 90 per cent of health claims); and if their organizations believe it is time for a new level of benefit plan management transparency and responsibility to all levels ‒ insurance providers/claims adjudicators, consultants, covered members, and service providers.

A new level of benefit plan transparency and responsibility is developing across all levels as the health system moves away, he said, from “counting prescriptions, dollars spent and physician visits” and tries to move to an accountable system that asks “what is the outcome, is the patient happy, did the patient get better, and was the money well invested to attain the outcome that we were going for?”

The bottom line, said Long, is governments and employers are looking for opportunities to increase the effectiveness of their spend and the focus is shifting from spend and activity to value and outcomes.

Biologic Therapies And Biosimilars

Biologic therapies are complex to build, and because they are produced by cells, it is difficult to create identical copies. Due to their effectiveness in treating patients, the uptake of biologic therapies has been extensive. As well, their price points represent the top drugs by expenditure in both public and private plans. Biosimilars by definition are similar to innovator biologic therapies, not identical. Health Canada approves a biosimilar when the biosimilar manufacturer has demonstrated that there are no clinically meaningful differences between the biosimilar and the reference biologic drug in terms of safety and effectiveness. However, competition resulting from the introduction of biosimilars into the market will result in significant savings for benefit plans.

Patients and physicians are two key groups that need to be on board to achieve the potential savings from the introduction of biosimilars. At issue for patients is will the biosimilar result in the same outcomes as their current biologic therapy? For patients being prescribed a biologic therapy for the first time, this is often not an issue. There is good evidence a biosimilar will be as effective. For patients already on biologic therapy, there is potential risk that switching to a biosimilar may trigger an immune response and may result in the biosimilar being less effective for the individual or create new side effects. “Health Canada considers well-controlled switch- es from a reference biologic drug to a biosimilar in an approved indication to be acceptable,” he said. Despite this recommendation, switching in Canada is more complex than switching in other markets. “In Canada we have multiple payers and biologic therapies are administered in the community. In Europe (Spain, Italy, France, and the UK) and the Norse countries (Sweden and Norway), there is often a single payer and biologics and biosimilars are specialty products based in hospitals,” said Long. Switching to biosimilars in other countries is, therefore, more systematic and more closely monitored.

Physicians have gained significant experience with biologic therapies. They often express concerns with the amount of information that is available to support replacement of the original biologic with a biosimilar. As experience through new starts and switching occurs, their comfort with the prescribing of biosimilars will increase. Physicians are watching the adoption of biosimilars in Europe and are talking to their colleagues “over the pond and gaining greater confidence in the use of biosimilars,” said Long.

For benefits plans this means that those already on biologics are not likely to be switched unless policy is adopted to force switching. Further for plans with product listing agreements ‒ where insurers are signing contracts to discount the cost of the original biologic therapy to match the biosimilar price ‒ patients will be continued on the original biologics.

Cancer Treatment Landscape

The use of drugs in cancer treatment is changing dramatically, said Long. A shift is occurring from the use of chemicals that kill cells indiscriminately to more focused treatments. However, with those more focused treatments, there is a jump in cost.

Further, within Canada there is a difference in how oral cancer therapies are funded depending on province. In the west (British Columbia, Alberta, Saskatchewan, and Manitoba) oral cancer therapies are funded within the cancer programs. There is a reduced need for private insurance to cover patient costs in these provinces. In the East (Ontario eastward), oral agents are funded through the provincial drug benefit plans. Those without provincial coverage turn to their employer plans to pick up the cost of these agents. As more oral cancer therapies are being introduced into the market there is increased pressure on all payers to cover the costs. In an effort to reconcile the differences, the Canadian Association of Provincial Cancer Agencies (CAPCA) has put in place a process to optimize how cancer drugs are funded and to harmonize how new cancer drugs are integrated into clinical pathways.

Now, when a cancer agency discusses, for example, two cancer drugs to treat the same disease, they try to determine:

- which of the two is better

- ways to create competition and a lower price point if there is no difference

- how to structure listings and use considering the mechanisms of action and cancer disease pathways

“What you are going to see come out of this is much more rigorous discussion of the choices we are making and the competition we are forcing to get the most appropriate listing,” said Long.

The provinces will increasingly focus on results. This makes “paying for a drug if it gets the patient that five extra years of life more palatable than if it only gives them 12 weeks,” he said.

Long went on to caution group in-surers, as it is unlikely they will be able to apply the same rigour to their review processes. “They probably don’t have the Canadian expertise sitting down to say what’s the likelihood of this and what is the place of therapy for this product versus the other one. Unless you truly un-not covering it, I’d be really hesitant as a payor to step into the cancer space and fund alternative therapies,” said Long.

Medical Marijuana

“Medical marijuana doesn’t fit into anything that we have that allows us to do what we usually do,” said Long. Since it is not classified as a drug, it does not have a DIN (Drug Identification Number) and “all of our regulations and legislation very specifically define what drugs are.” Yet, there is also an expectation that benefit plans administer marijuana as a drug so until Health Canada approves this as a drug, “we don’t know how to deal with it.”

Part of the issue is the research about the effectiveness of medical marijuana is lacking for a host of reasons. Pharmaceutical research now is being funded by organizations that see market potential for the products. However, because marijuana cannot be patented, no-one wants to invest in research on its usage which may not pay off.

Employers, beyond how they will cover marijuana in their benefit plan, must contend with health and safety issues, especially the use of medical marijuana by employees in safety-sensitive positions.

Confounding the issue, THC, the active ingredient in marijuana which creates the euphoria, doesn’t stay in the bloodstream. It goes into the fat tissues. With sudden shock or stress, the body releases cortisol. The cortisol causes THC to be released from the fat tissues. An employee who may have been unimpaired an hour ago, suddenly has their THC levels go up, clouding the brain and impairing their ability to perform their assigned safety sensitive tasks.

Under occupational health and safety regulations, both individuals using medical marijuana and their employers have a joint duty of care for safety to the individual under treatment and to all other employees on the worksite. Employees must understand that if they are suddenly feeling impaired, they have to declare this to their colleagues in the workplace and their employers to comply with this joint duty of care.