Maximizing Your Pension Strategy for a Multigenerational Workforce

According to the Chamber’s annual “Saskatoon Business Barometer,” the forecast for Saskatoon’s business community is bright. The survey revealed confidence in the economic opportunities for businesses to thrive but cited challenges that have Saskatchewan employers re-evaluating their attraction and retention strategies for 2023.

- Growth: The challenge most frequently mentioned in the survey was labour supply (27%).

- Hiring: 52% expect their workforce to increase over the next year, but only 34% are confident they can hire the employees they need.

- Workforce strategies: Top strategies to meet business needs and address labour shortages included focusing on retaining existing workers (56%).1

Benefits and pension are essential in any attraction and retention strategy, but the preferred features of the total rewards program differ across the multiple generations in today’s workforce.

What do employees want?

Below, our Sutton Employee Engagement Wheel™ demonstrates the key components of a total rewards program. One critical component is pension – it’s more important than ever. While many businesses offer a group retirement savings plan, communication about it is often generic, which can diminish the value employees perceive.

Role of Pension in Attraction, Retention, and Productivity

Role of Pension in Attraction, Retention, and Productivity

- It’s critical: 84% of Canadian employees consider an employer-sponsored retirement plan critical; 60% would be unlikely to work for a company without one.2

- It improves productivity: 60% said they worry about personal finances at work at least weekly;3 46% say they spend 3.5 hours per week on financial issues.

- It’s tax-effective: You can increase compensation without additional payroll taxes.

Clearly, both the employer and the employee benefit when a pension is part of total rewards. The critical question facing employers is how to make their pension or group savings plan stand out as a competitive advantage.

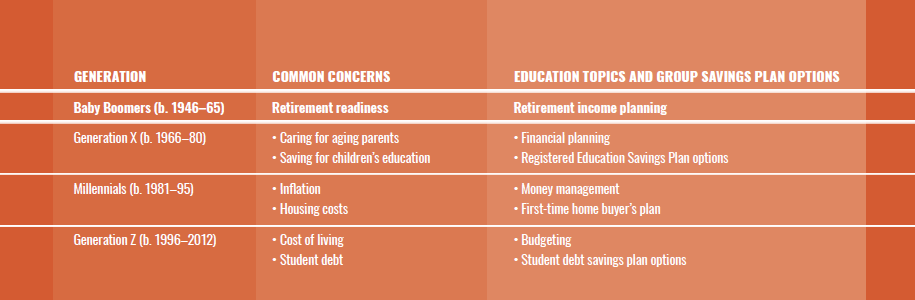

For the first time ever, the workforce consists of five generations. A group savings plan offers advantages at every stage of life in addition to saving for retirement. But how do you communicate the value of the plan to empower employees with financial and lifestyle change readiness?

What employers highlight in their group plan communications should be different for Generation Z employees than for Baby Boomers. The retirement concerns of the oldest group, the Traditionalists (b. 1922–45) should be addressed one-on-one with a financial advisor, but below are examples for the others of common financial stressors, along with topics for employee education and options to include in your group savings plan.

Communication is key

Tailoring communication to the different generations in your workplace and offering financial education to employees enhances value and maximizes the results of your investment. You, the employer, provide the plan and should be a trusted resource for information. Keep employees informed about online features and financial tools and provide various forms of communication. Sending emails, posting information on bulletin boards, and including details in newsletters is good, but holding plan information meetings with your trusted pension advisor and following up with webinars, videos, and printed materials will help reach employees with different learning styles.

Pension plans are important for attracting and retaining valued employees. Communication strategies that effectively engage employees in their plan will help mitigate financial stressors, strengthen the employee experience, and improve employee productivity. As Saskatchewan employers re-evaluate their strategies to address labour shortages, they can leverage existing benefits and pension plans without spending more by developing a thoughtful, intentional marketing and communication plan.

First Published in PotashWorks 2023.

1. Bright forecast: Chamber’s annual ‘Saskatoon Business Barometer’, The Chamber, Oct. 25, 2022.

2. 84% of employees consider retirement plan a critical benefit: survey, Benefits Canada, Jan. 25, 2002.

3. 84% of employees consider retirement plan a critical benefit: survey