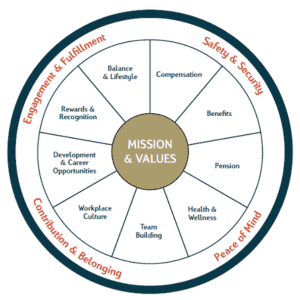

Total rewards comprise many components beyond cash compensation. Employers have conscious decisions to make. Are you going to focus on base salary (the money) or total rewards when trying to attract and retain employees?

Employees today are not thinking just about the money when choosing an employer. They’re prioritizing what they value in life and looking for workplaces that support work-life balance and a healthier lifestyle. Here’s one model: the Sutton Employee Engagement Wheel™ illustrates nine components of total rewards, balancing both extrinsic (monetary) and intrinsic (non-monetary) rewards. You’ll notice that compensation is only one component.

From my experience, one aspect of rewards that’s often overlooked is the tax-efficiency of different forms of compensation. Consider the tax consequences of a three per cent merit increase in salary. For the employer, a three per cent increase in payroll also means an increase in CPP, EI, vacation pay, and WCB costs. For the employee, it means receiving only about a two per cent increase in compensation after factoring in what they pay toward CPP, EI, and income tax.

Here are three tax-efficient forms of compensation that will bring more balance to your total rewards package if it’s been tilted toward base salary.

1) Traditional group benefits plans

Group insurance policies can have two components: taxable and nontaxable – the premiums and the benefits. Employer-paid premiums for life, accidental death and dismemberment (AD&D), disability, and critical illness insurance are considered taxable benefits. Most employers will have employees pay those premiums instead of employees paying tax on the premiums. Employees also usually pay for disability premiums so that any claim payments received are tax-free.

However, health, dental, and employee assistance program premiums paid by employers are non-taxable benefits. Budgeting three per cent of payroll can fund a comprehensive health and dental plan. Surveying your employees and benchmarking your benefits plan provides good data to help you make decisions. If your benefits plan is below market, enhancing coverage to fill any gaps can bring far more value than the

equivalent dollars in pay. A full copy of “Tax Status of Group Benefits” is available on request.

2) Health Spending Accounts (HSAs)

HSAs are a non-taxable alternative or supplement to a traditional benefits plan. Eligible health-related expenses include vision, dental, and more. What qualifies as an eligible expense is governed by the CRA. The employer has complete control over which employees are covered under the plan and how much they are given to spend.

Consider an employee earning $75,000 annually. What is the perceived value of a one per cent increase

in wages compared with a $750 non-taxable health spending account? Not only is the $750 HSA non-taxable to the employee, but those dollars do not attract payroll taxes and it’s only a cost to the company

if the employee submits eligible claims.

3) Deferred Profit Sharing Plan (DPSP)

Do you have a group retirement savings plan? Contributions made to a group RRSP are considered taxable income. They are treated the same way as a pay raise so any contributions will attract all the regular payroll taxes such as CPP, EI, and Workers Compensation. However, employer contributions made to a pension plan or DPSP are not considered as regular income in the same way. That means your business gets to avoid those payroll taxes, allowing you to provide compensation in a more tax-effective way.

You have the option to tie contributions to company performance as well, so employer expenses can be

reduced when the company is not as profitable. Employers can also set vesting periods that allow greater

control. Vesting periods can be as long as two years. If employees quit or are terminated before that time,

the employer contribution for them stays with the company. To optimize compensation dollars, a higher percentage matching contribution to a DPSP versus an increase in wages is a smart decision.

We all want the most value from our dollars. Before automatically giving a three per cent merit increase, evaluate your tax-efficient rewards and your total rewards plan. An increase in wages may cost you more than you think, especially if you lose a key employee who thinks beyond “show me the money”.

First published in the 2022 edition of PotashWorks Magazine.